Are Care Home Costs Tax Deductible . — you could claim the medical expenses tax offset for net eligible expenses relating to: — if you operate some or all of your business from home, you may be able to claim tax deductions for the business. This tax reduction is income tested,. — my husband is in residential aged care and i am working and paying tax. Can i claim a tax deduction on the daily. Includes information on what you can and. in australia, there are a range of medical expenses that can be claimed as tax deductions, aged care included. If you have a dedicated home office, claim a portion of your rent, utilities, and internet based on the dedicated work area. learn more about the tax deductions aged care workers can claim during tax time.

from www.canaccordgenuity.com

Includes information on what you can and. This tax reduction is income tested,. in australia, there are a range of medical expenses that can be claimed as tax deductions, aged care included. — if you operate some or all of your business from home, you may be able to claim tax deductions for the business. learn more about the tax deductions aged care workers can claim during tax time. — you could claim the medical expenses tax offset for net eligible expenses relating to: If you have a dedicated home office, claim a portion of your rent, utilities, and internet based on the dedicated work area. Can i claim a tax deduction on the daily. — my husband is in residential aged care and i am working and paying tax.

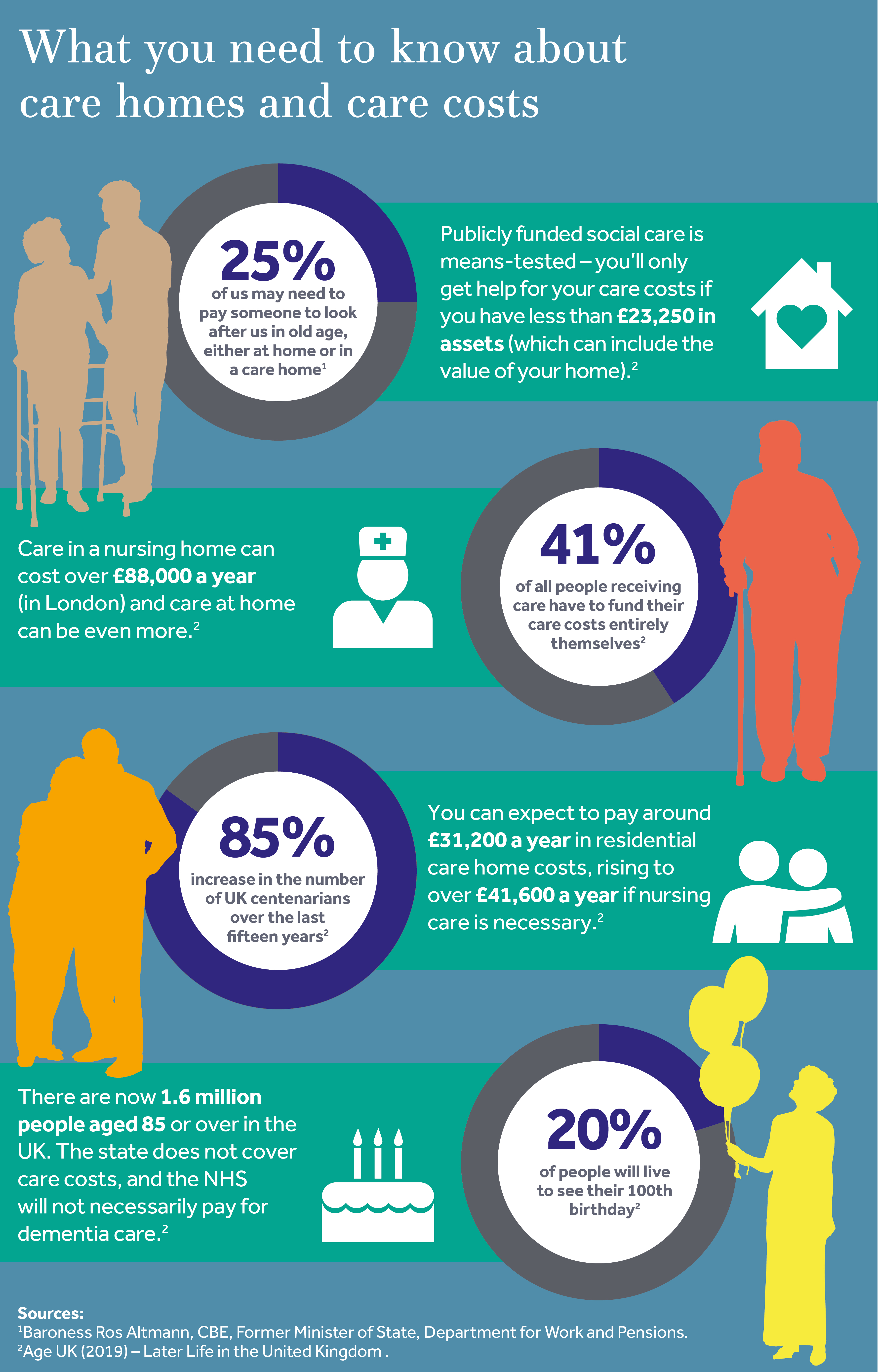

Wealth & Tax Planning For Long Term Care Home Costs CGWM UK

Are Care Home Costs Tax Deductible — you could claim the medical expenses tax offset for net eligible expenses relating to: Can i claim a tax deduction on the daily. learn more about the tax deductions aged care workers can claim during tax time. in australia, there are a range of medical expenses that can be claimed as tax deductions, aged care included. Includes information on what you can and. — my husband is in residential aged care and i am working and paying tax. — you could claim the medical expenses tax offset for net eligible expenses relating to: If you have a dedicated home office, claim a portion of your rent, utilities, and internet based on the dedicated work area. This tax reduction is income tested,. — if you operate some or all of your business from home, you may be able to claim tax deductions for the business.

From www.slideteam.net

Nursing Home Costs Tax Deductible In Powerpoint And Google Slides Cpb Are Care Home Costs Tax Deductible in australia, there are a range of medical expenses that can be claimed as tax deductions, aged care included. Includes information on what you can and. — if you operate some or all of your business from home, you may be able to claim tax deductions for the business. This tax reduction is income tested,. — you. Are Care Home Costs Tax Deductible.

From learningschoolgraciauwb.z4.web.core.windows.net

In Home Daycare Tax Deductions Are Care Home Costs Tax Deductible — if you operate some or all of your business from home, you may be able to claim tax deductions for the business. This tax reduction is income tested,. — you could claim the medical expenses tax offset for net eligible expenses relating to: If you have a dedicated home office, claim a portion of your rent, utilities,. Are Care Home Costs Tax Deductible.

From dxoulhjeq.blob.core.windows.net

Bed Tax Nursing Home at Ada Murrah blog Are Care Home Costs Tax Deductible Can i claim a tax deduction on the daily. If you have a dedicated home office, claim a portion of your rent, utilities, and internet based on the dedicated work area. — my husband is in residential aged care and i am working and paying tax. Includes information on what you can and. — you could claim the. Are Care Home Costs Tax Deductible.

From www.msn.com

Are Nursing Home Expenses Tax Deductible? Are Care Home Costs Tax Deductible If you have a dedicated home office, claim a portion of your rent, utilities, and internet based on the dedicated work area. — if you operate some or all of your business from home, you may be able to claim tax deductions for the business. This tax reduction is income tested,. learn more about the tax deductions aged. Are Care Home Costs Tax Deductible.

From exoncfrju.blob.core.windows.net

Average Cost Of Nursing Home In Iowa at Donnie Carter blog Are Care Home Costs Tax Deductible If you have a dedicated home office, claim a portion of your rent, utilities, and internet based on the dedicated work area. — you could claim the medical expenses tax offset for net eligible expenses relating to: — my husband is in residential aged care and i am working and paying tax. in australia, there are a. Are Care Home Costs Tax Deductible.

From ukcareguide.co.uk

CARE HOME COSTS in 2017 Use our calculator to estimate care home fees Are Care Home Costs Tax Deductible — if you operate some or all of your business from home, you may be able to claim tax deductions for the business. Can i claim a tax deduction on the daily. If you have a dedicated home office, claim a portion of your rent, utilities, and internet based on the dedicated work area. in australia, there are. Are Care Home Costs Tax Deductible.

From www.canaccordgenuity.com

Wealth & Tax Planning For Long Term Care Home Costs CGWM UK Are Care Home Costs Tax Deductible learn more about the tax deductions aged care workers can claim during tax time. Includes information on what you can and. — my husband is in residential aged care and i am working and paying tax. If you have a dedicated home office, claim a portion of your rent, utilities, and internet based on the dedicated work area.. Are Care Home Costs Tax Deductible.

From hopeparkhouse.co.uk

How Much Do Residential Care Homes Cost? Hope Park House Are Care Home Costs Tax Deductible in australia, there are a range of medical expenses that can be claimed as tax deductions, aged care included. This tax reduction is income tested,. — if you operate some or all of your business from home, you may be able to claim tax deductions for the business. learn more about the tax deductions aged care workers. Are Care Home Costs Tax Deductible.

From azexplained.com

Are Health Care Costs Tax Deductible? AZexplained Are Care Home Costs Tax Deductible — you could claim the medical expenses tax offset for net eligible expenses relating to: — my husband is in residential aged care and i am working and paying tax. — if you operate some or all of your business from home, you may be able to claim tax deductions for the business. If you have a. Are Care Home Costs Tax Deductible.

From www.youtube.com

Assisted Living Expenses May Be Tax Deductible YouTube Are Care Home Costs Tax Deductible — you could claim the medical expenses tax offset for net eligible expenses relating to: This tax reduction is income tested,. in australia, there are a range of medical expenses that can be claimed as tax deductions, aged care included. If you have a dedicated home office, claim a portion of your rent, utilities, and internet based on. Are Care Home Costs Tax Deductible.

From www.agingcare.com

Can I Deduct Medical Expenses I Paid for My Parent? Are Care Home Costs Tax Deductible — my husband is in residential aged care and i am working and paying tax. learn more about the tax deductions aged care workers can claim during tax time. — if you operate some or all of your business from home, you may be able to claim tax deductions for the business. Can i claim a tax. Are Care Home Costs Tax Deductible.

From www.housesumo.com

Are Home Improvement Costs Tax Deductible? What You Need to Know Are Care Home Costs Tax Deductible — if you operate some or all of your business from home, you may be able to claim tax deductions for the business. — my husband is in residential aged care and i am working and paying tax. learn more about the tax deductions aged care workers can claim during tax time. — you could claim. Are Care Home Costs Tax Deductible.

From exokgjdvg.blob.core.windows.net

Home Health Care Costs Tax Deductible at David Spears blog Are Care Home Costs Tax Deductible in australia, there are a range of medical expenses that can be claimed as tax deductions, aged care included. If you have a dedicated home office, claim a portion of your rent, utilities, and internet based on the dedicated work area. — you could claim the medical expenses tax offset for net eligible expenses relating to: Can i. Are Care Home Costs Tax Deductible.

From www.healthcarereformmagazine.com

Are Home Care Expenses Tax Deductible? Health Care Reform Are Care Home Costs Tax Deductible If you have a dedicated home office, claim a portion of your rent, utilities, and internet based on the dedicated work area. — you could claim the medical expenses tax offset for net eligible expenses relating to: in australia, there are a range of medical expenses that can be claimed as tax deductions, aged care included. Can i. Are Care Home Costs Tax Deductible.

From marylandhealthconnection.gov

Deductible Maryland Health Connection Are Care Home Costs Tax Deductible — if you operate some or all of your business from home, you may be able to claim tax deductions for the business. Includes information on what you can and. This tax reduction is income tested,. in australia, there are a range of medical expenses that can be claimed as tax deductions, aged care included. learn more. Are Care Home Costs Tax Deductible.

From medicarelifehealth.com

Is Assisted Living Tax Deductible Medicare Life Health Are Care Home Costs Tax Deductible If you have a dedicated home office, claim a portion of your rent, utilities, and internet based on the dedicated work area. Includes information on what you can and. — my husband is in residential aged care and i am working and paying tax. — you could claim the medical expenses tax offset for net eligible expenses relating. Are Care Home Costs Tax Deductible.

From dxoptbfwp.blob.core.windows.net

Nursing Home Rates In Northern Ireland at Frederick Calvert blog Are Care Home Costs Tax Deductible This tax reduction is income tested,. If you have a dedicated home office, claim a portion of your rent, utilities, and internet based on the dedicated work area. Includes information on what you can and. — if you operate some or all of your business from home, you may be able to claim tax deductions for the business. Can. Are Care Home Costs Tax Deductible.

From medaco.co.uk

UK's Super Deduction Allowance and Your Care Facility Medaco Are Care Home Costs Tax Deductible If you have a dedicated home office, claim a portion of your rent, utilities, and internet based on the dedicated work area. Includes information on what you can and. — if you operate some or all of your business from home, you may be able to claim tax deductions for the business. This tax reduction is income tested,. . Are Care Home Costs Tax Deductible.